2025 Mid-Year Credit Market Update

- Chris Sweet, Managing Director | Head of Capital Advisory

- Scott Thomas, Senior Director, Capital Advisory

- John Stine, Senior Vice President

EXECUTIVE SUMMARY

The Portage Point 2024 Year-End Credit Market Update highlighted the record setting finish for the leveraged loan market in 2024, near multi-year low credit spreads and indicated optimism for an increase in mergers and acquisitions (M&A) financing activity as we entered the new year. This optimism was supported by –

- Reduction in uncertainty following the conclusion of the US Presidential election

- Perceived policy-related tailwinds for M&A activity through potential tax cuts and reduced regulation

- Fed reduction in base rates precipitated by moderating inflation

- Significant dry powder and robust demand driven by suppressed M&A and lack of new opportunities

- Backlog of unrealized exits and mounting pressure to return limited partner (LP) capital

Ultimately, however, through the first half of 2025, M&A deal activity fell short of expectations as escalating tariffs, policy-related uncertainty and increased volatility weighed on new deal activity. Notwithstanding a relatively strong start to 2025, the events surrounding Liberation Day in April led to a precipitous decline in private equity (PE) deal volumes and a temporary freeze in new loan issuance activity. Nonetheless, the fundamental catalysts for increased M&A activity that was highlighted at the beginning of the year remain intact and the supply-demand imbalance has only increased, accruing to the benefit of borrowers. While overall market sentiment has improved materially since April, we expect M&A will remain sporadic through the second half of 2025, with buyers and sellers remaining selective due to ongoing economic volatility, geopolitical uncertainty and persistent gaps in valuation. If uncertainty persists, business leaders and investors may restrict business investment and delay key decisions regarding inventory, capital expenditures and supply chain commitments, further hindering growth and deal making. However, if trade policy and associated impacts become more predictable, macroeconomic conditions stabilize and valuations recover, M&A exits could accelerate to satisfy robust investor demand for capital returns. We remain optimistic regarding the probability of increased M&A activity and believe the financing markets will remain supportive.

RECAP OF 1H 2025

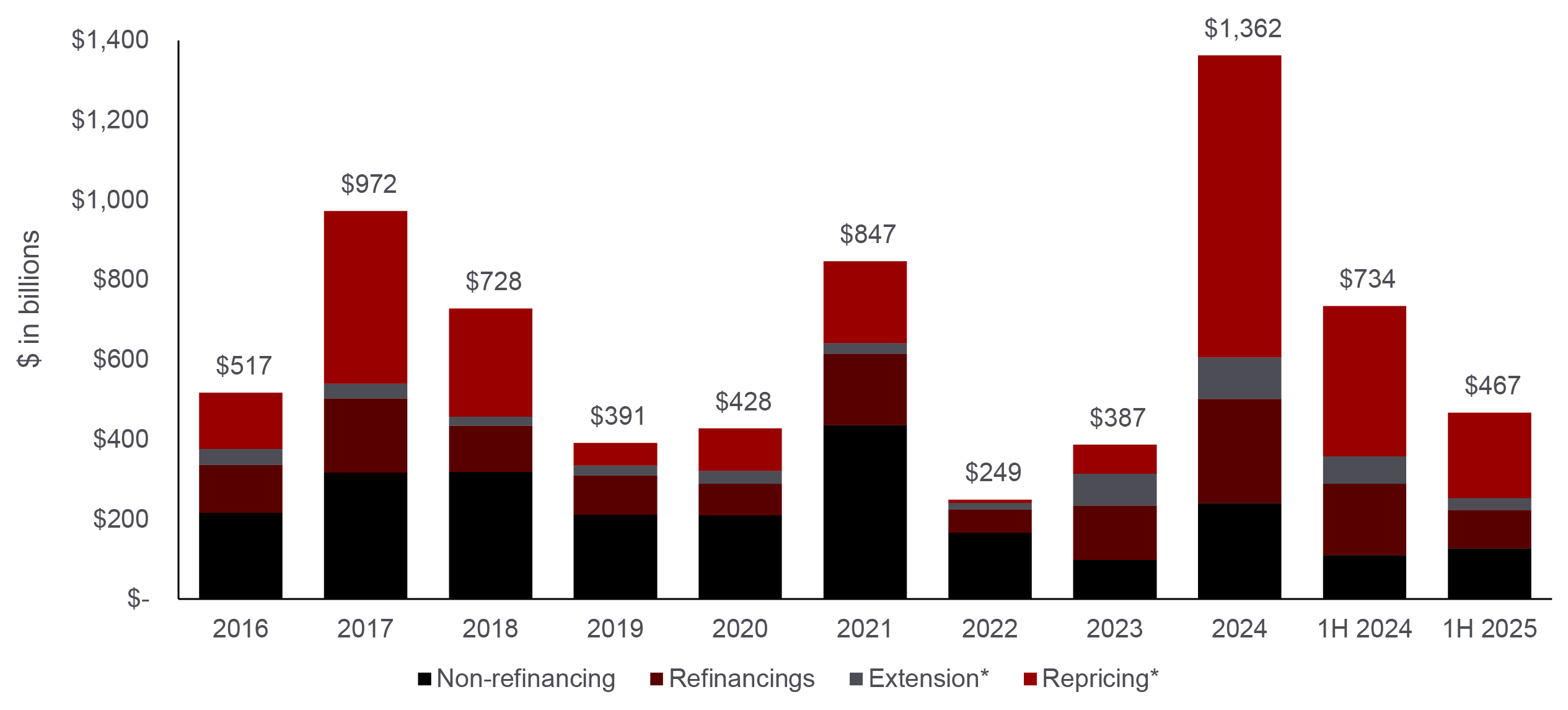

On the heels of a record setting year for overall new issue market activity, leveraged loan markets began the year with a record-breaking $215 billion of activity (including repricings) in January. However, volatility increased in subsequent months and ultimately peaked in April following the Liberation Day announcement and the onset of the trade war. As a result, PE M&A volume and overall loan market issuance activity came to a halt, as April recorded only $7.5 billion of loan issuance volume. For 15 consecutive business days through April 21, not a single broadly syndicated loan (BSL) transaction launched in the US, marking the longest stretch of inactivity in the BSL market since early 2020 during the onset of COVID-19. Following the spike in volatility, loan market conditions improved significantly, with issuance volume reaching $32.1 billion in May and further increasing in June.

Despite significant disruption, total leveraged loan activity still reached $467 billion in 1H 2025. While this represented a decrease of approximately 36% versus 1H 2024, it far exceeded full year totals recorded in 2022 and 2023. Notably, non-refinancing related activity (includes M&A) was $128 billion in 1H 2025 versus $111 billion in 1H 2024.

EXHIBIT 1 – US Institutional Loan Activity

Source – Pitchbook

*Reflects repricings and extensions done via an amendment process only.

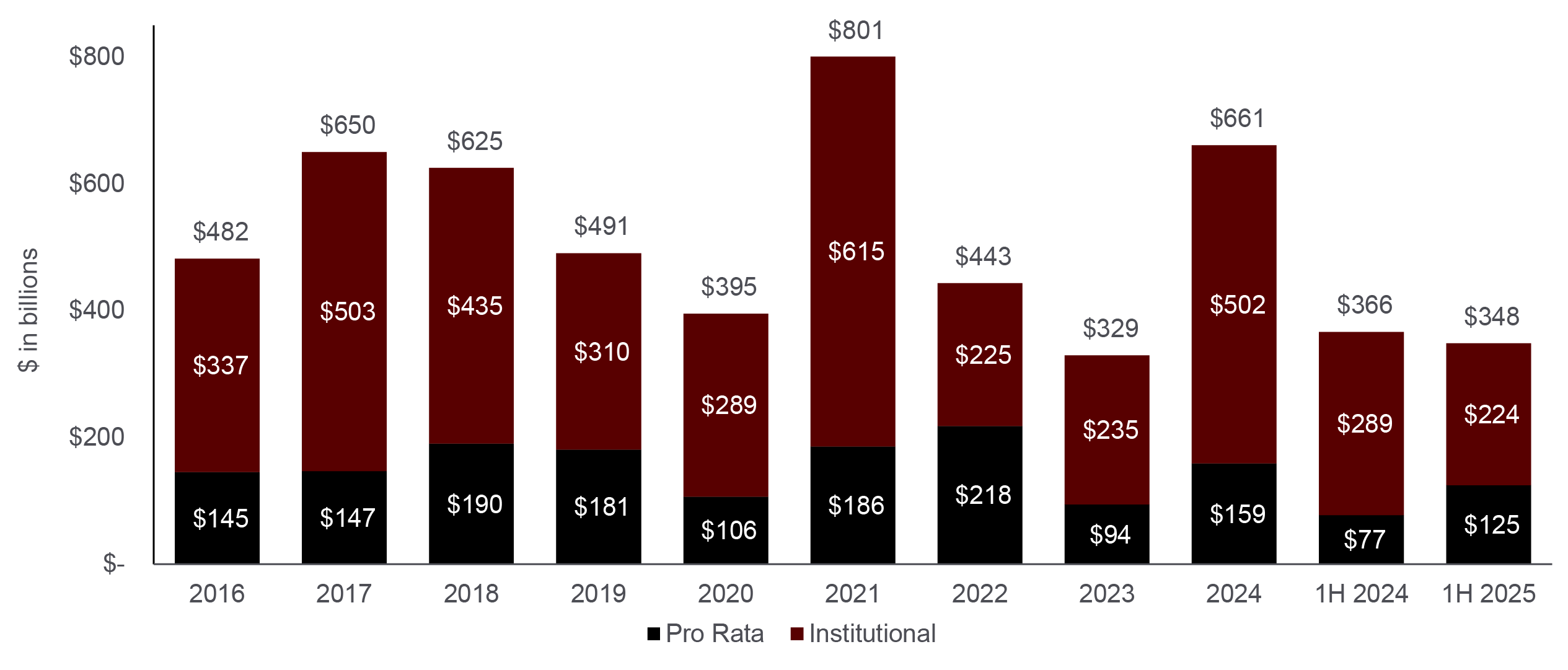

After removing credit agreement amendment activity, including repricings and maturity extensions, new-issue loan volumes across pro rata and institutional issuance totaled $348 billion in 1H 2025, representing only a modest 5% decline from 1H 2024.

EXHIBIT 2: US Leveraged Loan Issuance Volume

Source – Pitchbook

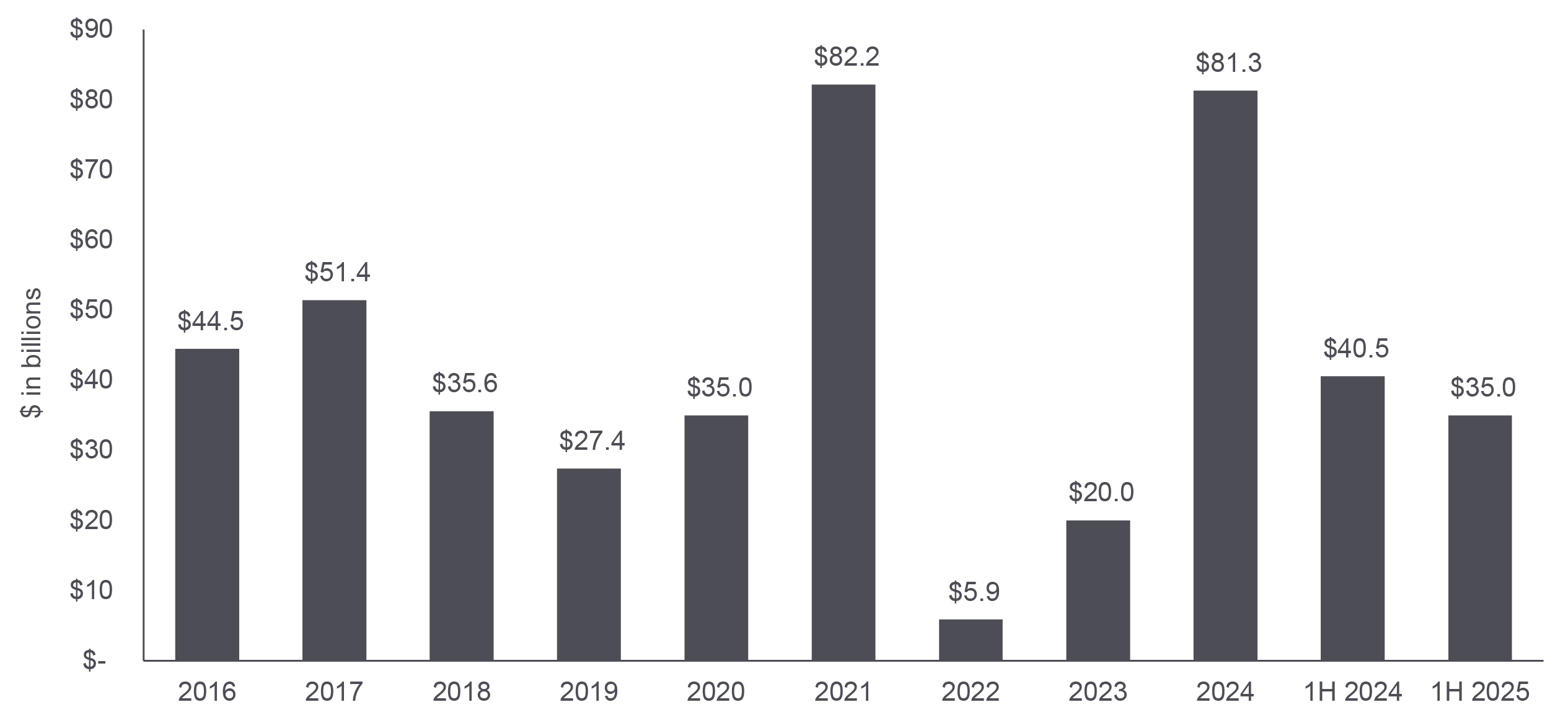

Amid a challenging M&A environment, dividend recapitalization activity has maintained its pace as businesses seek to generate liquidity and PE sponsors search for alternative ways to return capital to investors. In 1H 2025, dividend recapitalization volumes within the leveraged loan market reached $35 billion, just $5.5 billion (or 13%) short of 1H 2024 volumes, a year that ended with $81 billion of dividend recap volume (just shy of the all-time record for annual dividend recap loan issuance recorded in 2021).

Exhibit 3 – Institutional Leveraged Loan Dividend Recap Volume

Source – Pitchbook

As previously noted, the supply-demand imbalance and relative lack of new financing opportunities continues to benefit borrowers, as increased competition for assets has kept credit spreads near historic lows despite the slight widening in Q2 resulting from tariff driven volatility. Average new issue spreads for single B issuers were 334 basis points in Q1 2025, their lowest in at least seven years. In Q2 2025, single B spreads widened merely 10 basis points, despite significant market turmoil in the wake of Liberation Day. Although issuance volumes have declined year-over-year in 1H 2025, borrowers continue to take advantage of credit spread compression by opportunistically pursuing transactions to reduce their cost of capital, extend maturities and fund dividends.

EXHIBIT 4 – Average New-Issue Spread by Borrower Rating

Source – Pitchbook

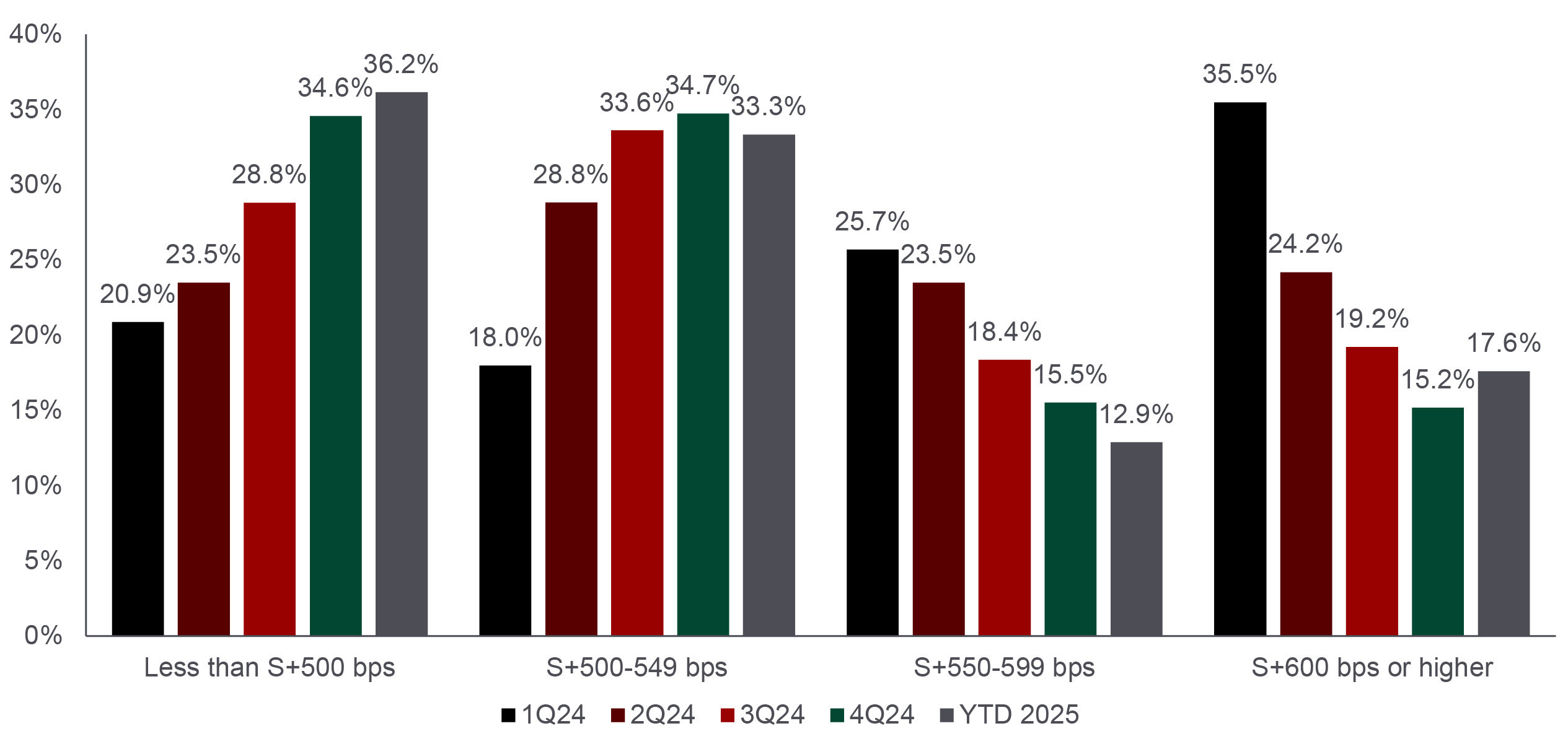

In the private credit market, robust lender demand and borrower friendly terms have persisted. However, data shows that pricing distribution has become slightly more bifurcated from a pricing perspective. In 1H 2025, approximately 36% of new sponsor-backed issuances were priced below S + 500 bps, an increase of approximately two percent versus Q4 2024 and more than 12% higher than 1H 2024. However, new sponsor-backed issuances priced above S + 600 bps also increased from approximately 15% in Q4 2024 to nearly 18% in Q2 2025, reversing the declining trend recorded over the course of 2024. We attribute this shift to increased lender demand for higher quality opportunities amid market volatility and uncertainty in 1H 2025 as well as slightly wider pricing for more challenging situations where lenders can find more yield.

EXHIBIT 5 – Distribution of New-Issue Spreads for Sponsor-backed Direct Lending Transactions

Source – Pitchbook

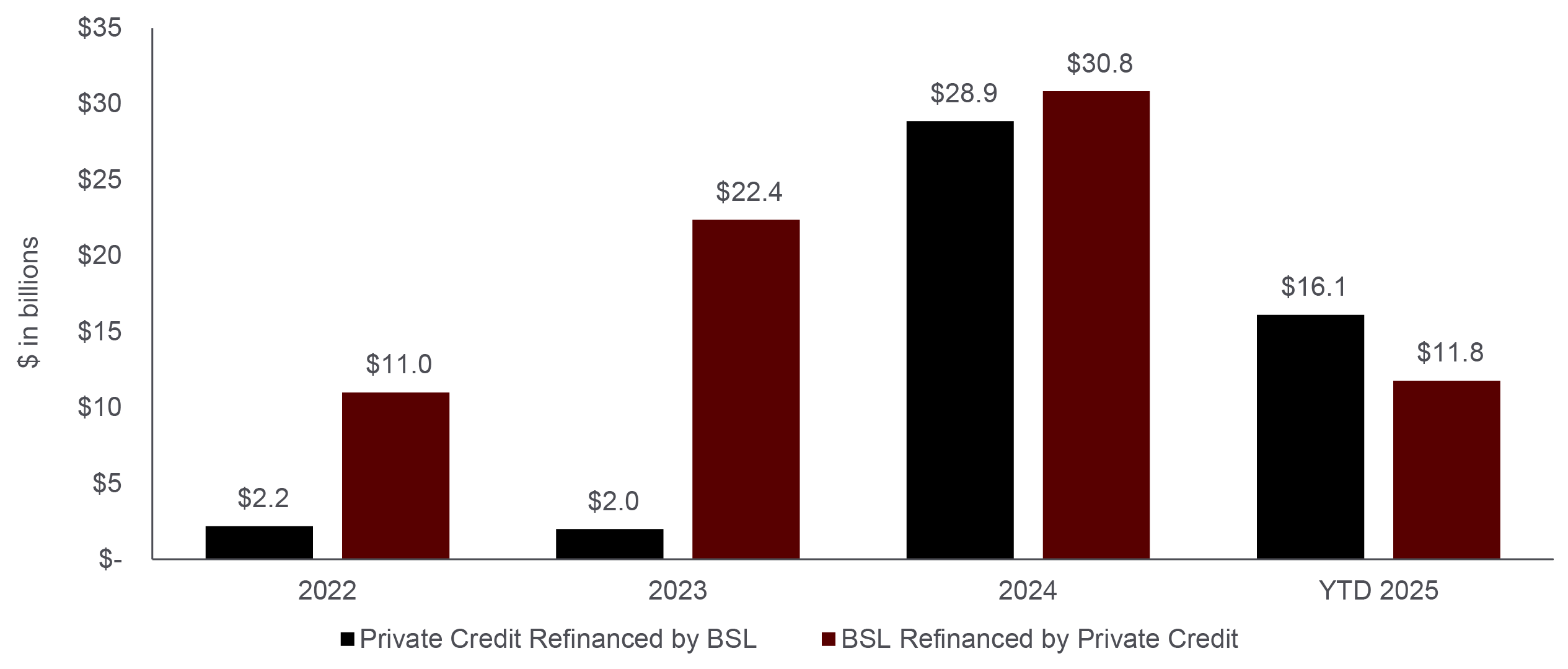

Private credit and the BSL market continue to compete for assets. During 1H 2025, BSL refinancings of private credit facilities reached nearly $16 billion to maintain their pace relative to 2024. Over the same period, private credit refinancings of BSL facilities reached nearly $12 billion, but remain slightly below their 2024 pace. Private credit lenders remain a formidable competitor in the upper middle market and the preferred solution for true middle market and lower middle market borrowers.

EXHIBIT 6 – Refinancing Activity – Broadly Syndicated Loans and Direct Lending Takeouts

Source – Pitchbook

LOOKING AHEAD

Although economic uncertainty and trade policy drove significant market volatility and disrupted loan issuance activity in the first half of the year, credit markets quickly rebounded with total leveraged loan issuance reaching $467 billion in 1H 2025. Credit spreads remain near multi‑year lows, underscoring robust underlying demand. The persistent supply‑demand imbalance and continued spread compression have created a borrower-friendly environment allowing companies to opportunistically extend maturities, reduce funding costs and pursue dividend recapitalizations on favorable terms. M&A activity and related financing continue to lag, however, we remain optimistic that the eventual easing of trade policy and economic uncertainties will catalyze renewed M&A activity.

THE PORTAGE POINT DIFFERENTIATED APPROACH TO CAPITAL ADVISORY SERVICES

Portage Point is a business advisory and investment banking business focused on providing holistic financial advisory services and solutions to sponsored and non-sponsored companies in the middle market. Our Capital Advisory team partners with each client to evaluate capital requirements, structure tailored financing solutions and run competitive and efficient financing processes to provide certainty of execution for our clients and optimize financing outcomes based on unique client goals and priorities. Our team leverages years of transaction execution experience and deep lender relationships across the credit provider landscape to develop an effective process strategy and craft thoughtful marketing materials which highlight attractive business credit attributes while addressing and properly positioning key lender diligence topics. In the constantly evolving private credit and middle market financing landscape, it is critical for middle market companies, financial sponsors and management teams to have an experienced and trusted advisor to navigate this marketplace and secure the financing they require to fund their businesses.

The Portage Point differentiated, cross-functional platform enables the firm to add value for clients across a range of capabilities and solutions prior to, during and after a financing transaction. These services may include financial and operational due diligence, transaction execution services and performance improvement initiatives and more.

Footnotes

1. Pitchbook LCD data for BB-, B+, B and B- credit spreads through June 30, 2025 as reported in the Q2 2025 US Credit Markets Quarterly Wrap Report

2. Pitchbook LCD data for historical leveraged loan dividend recap activity through June 30, 2025 as reported in the Q2 US Credit Markets Quarterly Wrap Report

Disclaimer

Investing in securities involves risk, including the potential loss of principal. The value of investments can go down as well as up, and investors may not get back the full amount originally invested. Past performance is not indicative of future results. All investments carry some degree of risk, including the potential for loss of principal.

Private credit typically refers to debt investments in privately negotiated loans or debt securities. Private credit offers potential benefits such as higher yields, customization of terms, and a focus on steady income generation, but it comes with drawbacks like illiquidity and higher credit risk due to the nature of borrowers involved.

In contrast, broadly syndicated loans are large loans provided by a group of lenders to a single borrower. Broadly syndicated loans are typically rated and have standardized terms, making them more transparent and easier to benchmark. However, they may offer lower yields and less flexibility in terms compared to private credit.

Investing in debt securities is not suitable for all investors. Economic downturns, changes in interest rates, and complex contractual terms further contribute to the risk profile of investing in debt. It is important to conduct thorough research and consider your risk tolerance before making any investment decisions.

This document is for informational purposes only and does not constitute an offer or solicitation to purchase or sell securities. Investors should seek advice from a qualified financial advisor and conduct their own research and due diligence before making any investment decisions.

There is no assurance that any investment strategy will achieve its objectives. All investing involves risk, including the possible loss of principal. Diversification does not guarantee a profit or protect against loss in declining markets.

Investment Banking Services are offered through Triple P Securities, LLC. Member FINRA SIPC. Firm details on FINRAs BrokerCheck.