Beyond Consolidation – Enabling Sustainable Value Creation in Dental Service Organizations

- Chris Vasta, Senior Director

- John McKinnis, Managing Director

- Arun Lamba, Managing Director | Head of Performance Improvement

The US dental market is forecast to reach $200 billion by 2030, up from $148 billion in 2023,1 driven by expanding insurance coverage and rising patient volumes. Many independent dental practices are merging with dental service organizations (DSOs) backed by private equity (PE) to maintain competitive positioning in a growth environment.

Yet consolidation alone cannot drive sustained competitiveness and value. Many DSO integrations fail to capture operational synergies that maximize platform value. Fragmented systems, inconsistent standards and cultural misalignment can detract substantial value. Meanwhile, elevated interest rates are leading PE sponsors to hold DSO investments for extended periods, and as a result, investors cannot rely solely on sector tailwinds and multiple expansion to drive growth. True value creation demands transformation from disparate practices into integrated networks delivering measurable synergies.

The Middle Market DSO Challenge

DSOs face operational headwinds that consolidation strategies alone cannot address

| Inconsistent operational standards across acquired practices | Persistent labor shortages limiting capacity and growth potential | Technology integration complexities hampering clinical and administrative efficiency | Payor interaction and claims management challenges creating revenue cycle bottlenecks | Workplace culture challenges contributing to high attrition rates |

Essential Steps to Overcoming DSO Obstacles

To overcome obstacles, DSOs must employ a holistic approach to organizational management and develop performance tracking, data input and people management frameworks. Sticking to these frameworks requires discipline and time investment but will ultimately ensure DSOs maximize platform value creation. (Note, these dynamics are applicable across many multi-location healthcare services business types, e.g., veterinary, ophthalmology and dermatology practices.)

|

1. Establish Unified LeadershipDSOs comprise individual and local practices, each with individual operation management, record keeping and patient interaction methods. Integrating each practice into a cohesive network with consistent operating standards requires a strong, unified leadership foundation. Effective DSO leaders are |

Finding DSO leadership talent can be difficult, especially as experience does not necessarily correlate with expertise on how to drive sustainable, transformative change. Further, competition for talent is strong, with qualified candidates in high demand. DSOs must prioritize leadership searches early to avoid disrupting key growth milestones. |

|

|

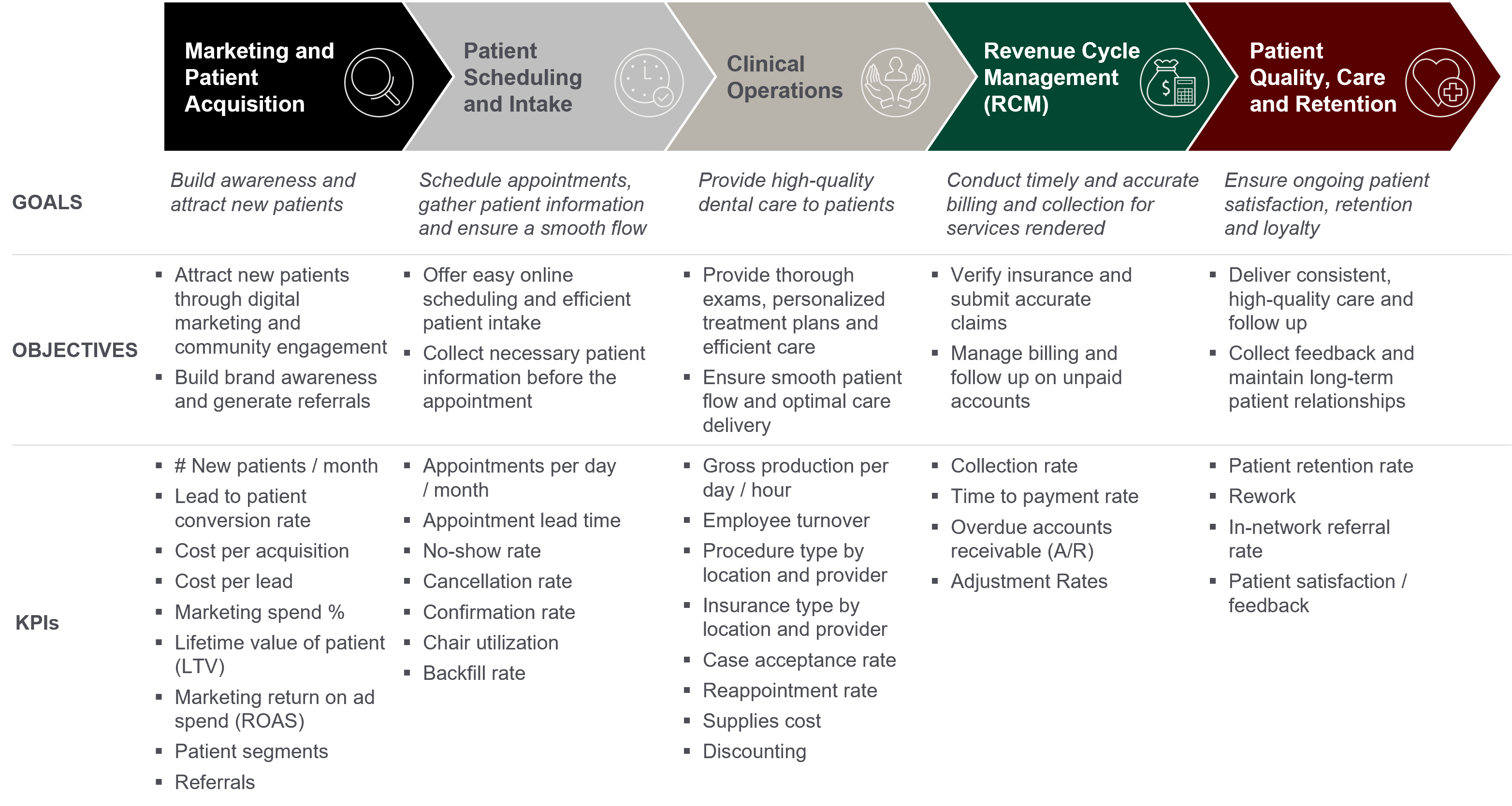

2. Standardize Operations and Performance ManagementEach individual practice that comprises a DSO will have unique methods for tracking performance. DSO leadership must evaluate, map and consolidate individual systems into a unified performance management system with trackable data and clear key performance indicators (KPIs). This foundation becomes critical for identifying operational inefficiencies and capturing value creation opportunities. Critical pieces to get right include |

|

|

|

3. Prioritize Clinic Culture and Effective Change ManagementClinical staff like hygienists, dental assistants and providers are in high demand. Dental hygienist employment is projected to grow by 7% from 2024 to 2034 – a figure much higher than the average for all occupations.2 As the aging population retains more natural teeth and therefore demand for preventative dental services rises, more staff are required. However, enrollment in dental hygiene programs declined during COVID-19. It may take years for the workforce to fully rebound. In addition to the competitive talent environment, new private equity ownership – and the resulting cultural shifts – can create friction if existing staff perceive increased scrutiny or rising expectations. High front-office turnover due to concerns around new policies or compensation can require practices to more frequently hire and train – which can lead to mistakes and frustration among clinical staff, resulting in low employee retention. Constant recruiting, hiring and training can quickly become expensive and can shake future buyer or investor confidence. But the root turnover cause is often not obvious. To mitigate attrition risk, DSO leadership needs to consider key factors when crafting operational strategies, including |

|

Demonstrating Value

Prioritizing unified leadership, standardized performance metrics and thoughtful change management can help DSOs demonstrate the qualities that investors are seeking. Stable revenue growth, operational consistency, high retention rates and the processes and technology to support sustained value creation are key to the long-term DSO success.

With these tenets in place, DSOs will be in an ideal position to provide the highest quality care to patients while maintaining profitable growth. When market conditions ripen for an exit, buyers will seek integration and performance improvement evidence, not just practice roll-up growth.

Footnotes

1 TechSci Research, “United States Dental Services Market By Size, Share and Forecast 2029F,” (2024)

2 US Bureau of Labor Statistics, “Dental Hygienists,” (May 2024)

The Portage Point Approach

Portage Point adopts a multidisciplinary approach to value creation, leveraging rich experience across DSO business operations – from revenue cycle management to staff retention to establishing clear KPIs – the Portage Point proven framework helps DSOs scale up and realize returns for PE sponsors. Our team provides holistic support, going beyond surface-level recommendations to highlight specific value creation initiatives and provide ground-level support throughout the implementation process.